In the ever-evolving landscape of mobile financial services, MTN MoMo (Mobile Money) stands as a cornerstone for millions of Ugandans, providing a reliable and convenient way to manage finances.

As we step into 2024, MTN Uganda has announced updates to its MoMo withdrawal charges. These changes are part of MTN’s commitment to improving service delivery while ensuring that the pricing structure remains competitive and fair.

This latest update aims to reflect the dynamic economic environment and customer usage patterns, ensuring that MTN MoMo continues to offer value and accessibility to all its users. In this post, we’ll delve into the specifics of these new charges, how they compare to previous rates, and what they mean for both individual and business customers in Uganda.

Consequently, understanding these charges is crucial for users to effectively manage their finances and make informed decisions when utilizing MTN MoMo services.

Overview of MTN MoMo Uganda

MTN MoMo, short for MTN Mobile Money, is a popular mobile money service offered by MTN Uganda.

It allows users to perform various financial transactions conveniently using their mobile phones, eliminating the need to travel long distances or wait in line at banks.

Here’s what you can do with MTN MoMo Uganda:

- Send and receive money: Transfer money to friends and family, or receive payments from others.

- Top up airtime and buy data bundles: Top up your own phone or someone else’s, and purchase mobile data bundles.

- Pay bills: Pay utility bills, subscriptions, and other payments directly from your MoMo account.

- Shop at merchants: Many businesses in Uganda accept MTN MoMo as a payment method.

- Access other financial services: Get access to loans, savings products, insurance, and more through MoMo.

Understanding the MTN MoMo Uganda Withdrawal Charges

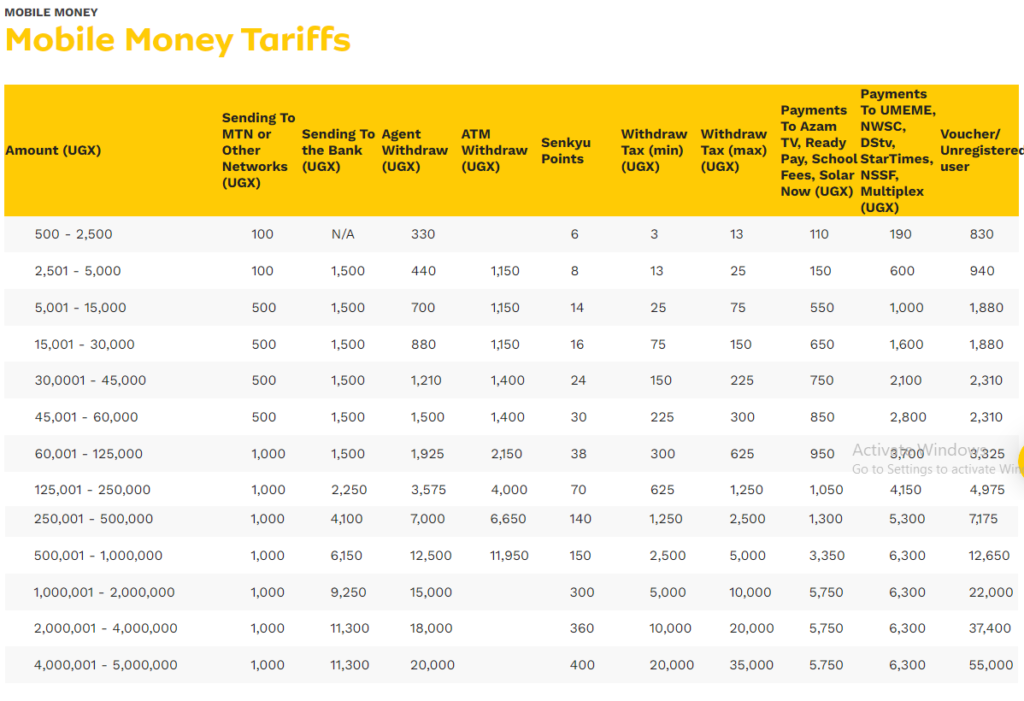

MTN MoMo withdrawal charges are categorized based on the chosen withdrawal method.

Here’s a detailed breakdown of the various categories and their associated charges from the image above:

- Amount (UGX): This column shows the range of money you may want to withdraw.

- Sending To MTN or Other Networks (UGX): Fee for sending money to other MTN MoMo users or users on different mobile money networks.

- Sending To the Bank (UGX): Fee for sending money from your MoMo account to a bank account.

- Agent Withdraw (UGX): Fee for withdrawing money from an MTN MoMo agent.

- ATM Withdraw (UGX): Fee for withdrawing money using an ATM with a card linked to your MoMo account.

- Senkyu Points: These are loyalty points earned through MoMo usage. They can sometimes be redeemed to offset fees.

- Withdraw Tax (min) (UGX) / Withdraw Tax (max) (UGX): Taxes levied by the Ugandan government on mobile money withdrawals.

- Payments… (UGX): Fees for paying various services such as utilities, TV subscriptions, etc., directly from your MoMo account.

- Voucher / Unregistered user: Fees for sending money to someone who doesn’t have an MoMo account.

Important Considerations

- Minimum Transaction Amount: The minimum amount that can be withdrawn through any of the aforementioned methods is UGX 500.

- Maximum Transaction Limit: The maximum amount that can be withdrawn in a single transaction is capped at UGX 5,000,000.

- Account Balance Limit: The maximum balance that can be held in an MTN MoMo account is UGX 20,000,000.

- Taxes are automatically deducted from your account as part of your withdrawal costs.

Staying Informed

MTN Uganda encourages its customers to stay informed about the latest withdrawal charges by regularly checking their official website https://www.mtn.co.ug/tariffs/mobile-money-tariffs/ or contacting their customer care service for further clarification.

Therefore, by understanding these charges, MTN MoMo users can make informed decisions and optimize their mobile money transactions in Uganda.